Back in May 2014, I wrote a post titled The Connection Between Customer Satisfaction & Stock Price. The American Customer Satisfaction Index (ACSI) had recently made headlines, along with a 13-year financial analysis of the publicly traded companies in the index.

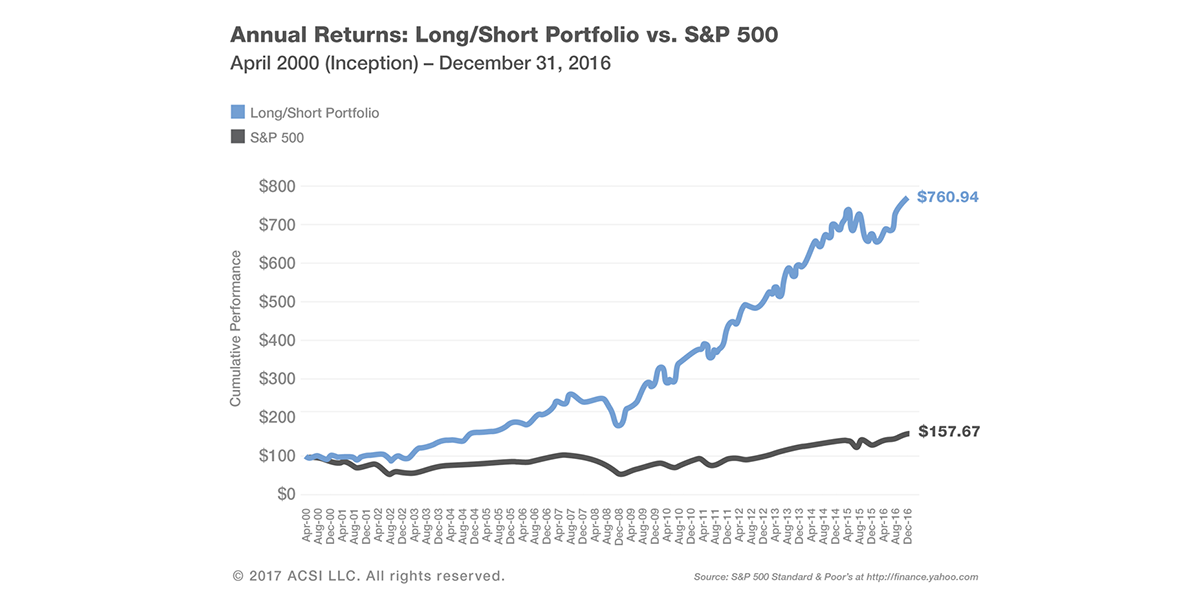

Here’s the gist of my post: The ACSI had created a stock portfolio comprising companies with the highest customer satisfaction scores in its yearly study. And that ACSI portfolio had significantly beaten the Standard & Poor’s (S&P) 500 stock market index over the past 13 years. One hundred dollars invested in the ACSI portfolio in April 2000 would have been worth a whopping $580 in 2013—and would have grown to just $121 on the S&P 500 in that same timeframe.

The data was similar a year later. By April 2015, the original ASCI investment peaked at $698 and the S&P just $138.

Recently the folks at the ACSI recently published their most current analysis—and, even more exciting, a new model for analyzing the stock performance of both high- and low-scoring companies on the ASCI.

Rather than pitting companies with high customer satisfaction against the S&P 500, they based their analysis on the following investment strategy: “The Long/Short Portfolio reflects investment decisions guided by ACSI data used to identify companies with the highest ACSI scores (for long positions) and lowest ACSI scores (for short positions).”

In other words, they betted on those companies with great customer experiences—and betted against (or shorted) those companies with poor customer experiences. The results of this Long/Short Portfolio are show in the image above, and they’re even more staggering than in years past. If you had followed this investment strategy since April 2000, an initial $100 investment would have been worth $761 at the end of 2016. That same investment would be worth just $158 on the S&P.

Even if you’re not a publicly traded company, you should take heed of these results. The mechanics that connect customer experience to stock price—via increased revenue and decreased cost to serve—are the same no matter your industry or size. But you must invest in customer experience in order to see these business results.