A hammer is the perfect tool for pounding nails into a 2×4, but would be terrible at cutting it in half. A basic handsaw would easily take care of that single cut, but probably wouldn’t be your saw of choice if you had to cut a pile of 1000 boards. Just as no tool in your toolbox is a fit for every task, no research methodology will help you answer every single question about your customers.

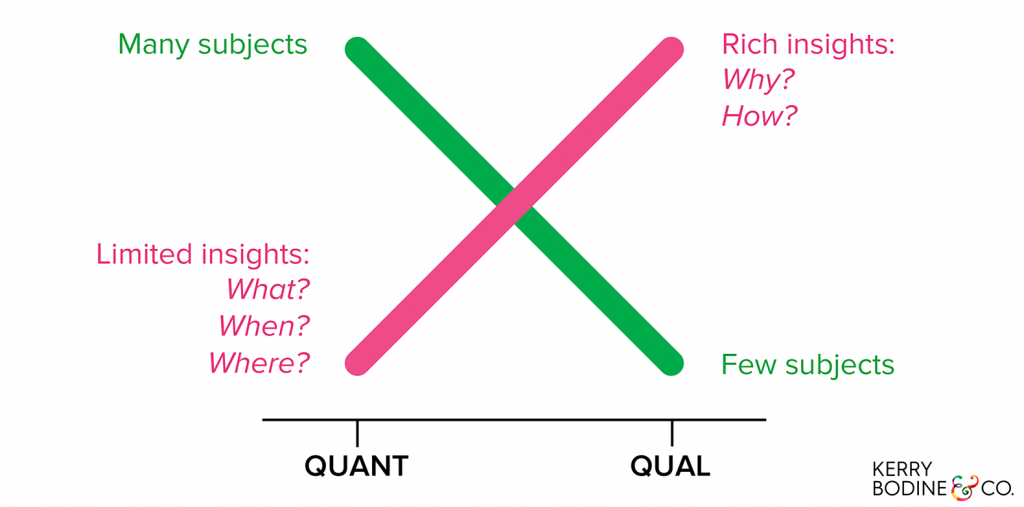

The first step towards picking the right methodology is to understand—at a high level—the relative strengths and weaknesses of quantitative and qualitative research.

Quantitative Research

Quantitative data is the stuff you can count and analyze statistically, like survey responses, site analytics, past purchase amounts, and the reasons customers call your support line.

- What’s great: With large enough data sets, you can get statistically significant results. That means you can be sure that the data represents the target customer group you’re looking to understand.

- The trade-off: Quantitative research provides limited insights. It can tell you what customers did, when, and where—but that’s about it. You’re not going to get any meaningful details about how exactly they did something or why.

Qualitative Research

Qualitative data is the output of research methods like interviews, observations, diary studies, focus groups, co-creation, collaging, and journey mapping workshops—and it needs some kind of subjective interpretation.

- What’s great: By watching what customers do, asking probing questions, and providing additional ways for customers to express themselves, you can uncover unmet needs and get a deep understanding of customers’ attitudes, perceptions, emotions, and desires.

- The trade-off: It’s just not feasible from a time or cost perspective to conduct in-depth qualitative research with large numbers of customers. That means there’s a chance that your participants don’t represent your larger customer base.

Quant/Qual Hybrid Research

In recent years, sentiment analysis on large qualitative data sets like survey verbatims and social media content has delivered insights that tap into the best of both qual and quant research.

- What’s great: If your data set is big enough, you can get statistically significant insights based on your customers’ open-ended—and, sometimes, unsolicited—comments and conversations.

- The trade-off: You’re limited by what your customers initially say. You can’t ask additional questions to dig deeper without a follow-up conversation.

***

Want more? Here’s a model to help you understand when in your research process to apply quant and qual methods to make the most of these trade-offs.