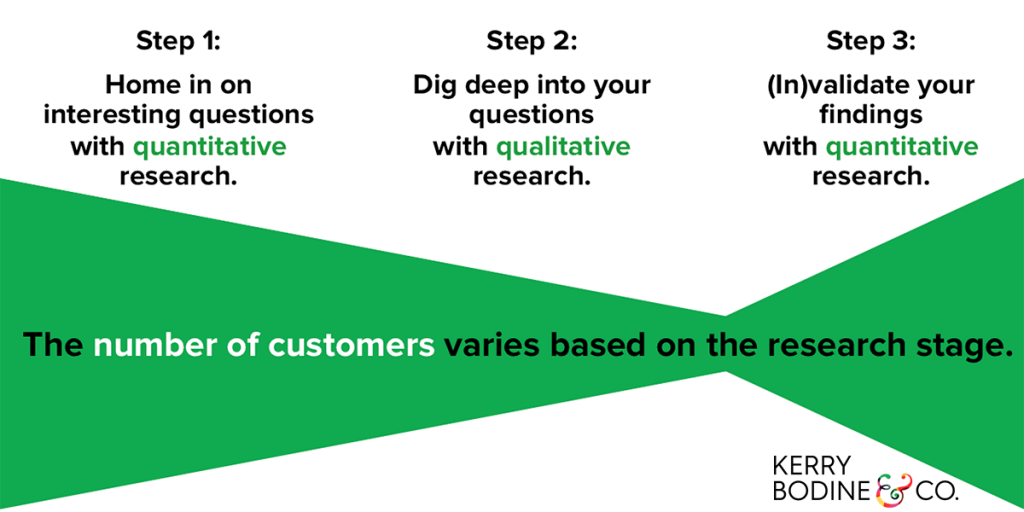

In a recent post, I talked about the trade-offs between quantitative and qualitative research. Here’s a quick summary: Neither is better than the other. Rather, they each have their relative strengths and weaknesses. But in order to get the most out of each research method, you need to properly sequence quantitative and qualitative research activities during your customer research efforts. Here’s how:

Step 1: Home in on interesting questions with quantitative research.

If you’re like every other company out there, you’re swimming in quant data. This includes customer survey responses (like NPS ratings), operational data (like the how long it takes your agents to resolve each case), and financial data (like how much of each product or service you sell).

Buried in that data are pointers to your customers’ key behaviors: what they’re doing, when, and where. In particular, you’re looking for behaviors that drive the business results you most care about, like increased revenue, customer loyalty, or support center costs. For example, your site metrics might point to spot where a large percentage of customers drop off before they purchase. Or your call center logs might show customers calling in with questions at particular spot in your loan application process.

Step 2: Dig deep into your questions with qualitative research.

But what this quant data can’t tell is exactly how your customers do certain things or why. What are your customers thinking when they abandon their shopping carts? Why do they find your loan application process so confusing? What attitudes or higher-level goals are driving their behaviors?

To answer these questions, you’ve got to engage in some qualitative research. For example, you might run some usability tests on your desktop and mobile sites. You might observe your customers filling out your loan application paperwork at their kitchen tables. Or you might conduct a journey mapping workshop to see how that loan application fits into a larger financial process, like buying a home.

Step 3: (In)validate your findings with quantitative research.

More likely than not, you’re going to uncover some golden nuggets in your qualitative research—gaps in customers’ knowledge about your business, surprising motivations, unmet needs, and a whole host of attitudes and emotions that contradict your prior assumptions. This is amazing stuff!

However, you can’t realistically conduct in-depth qualitative research with a statistically significant number of customers. So to determine whether your research participants’ sentiments truly represent your target customer segment—or just those of the participants you recruited—you’ll need to do some additional quant work.

For example, you could run a survey to ask customers about the specific needs or pain points that you discovered during your journey mapping workshop. You could examine your site stats for evidence of particular knowledge gaps showing up outside of the purchase funnel. Or you could look back at your support transcripts for evidence of certain emotions.

This three-step approach (which I like to call the “bow tie” method based on the graphic above) will ensure that you’ve found the right answers to your biggest customer questions—and guide you confidently into the process of making customer experience improvements.